On this page, you will find all the information you need to make the most of the convention !

*Note: Information will continue to be posted here until the convention.

- What: The largest gathering of actuarial students in North America

- When: January 16th – 18th, 2026

- Where: The Westin Ottawa, 11 Colonel By Dr, Ottawa, ON K1N 9J1

- Theme: “Embers of Change: Where Ideas Spark Impact”

We hope that your networking session was successful. Sponsors have valued the conversations you had and may wish to learn more about you. If so, they could invite you to participate in an interview or a coffee chat.

The links to schedule interviews and coffee chats will be made available here by Friday, January 16 at midnight.

Please make sure to complete the preference form by Friday, January 16 at 10:00 PM. This will allow us to consider your preferences in the event that multiple companies express interest in meeting with you.

If the form is not submitted by the deadline, interviews and coffee chats will be assigned to you at random, if you are selected.

Download the convention app to enhance your experience and stay connected! Get the most out of the app and have a more productive time at the event !

Supporting Details:

- NAVIGATE the event agenda and logistics, even without Wi-Fi or data. Access useful information like ridesharing and local attractions through the Community Board.

- NETWORK effectively by exploring attendee profiles and sending messages to plan your meetings.

- PARTICIPATE in event activities by liking sessions, leaving comments, giving ratings, engaging in live polls, tweeting, and more.

Convention Booklet

Explore the virtual version of the booklet distributed during the convention :

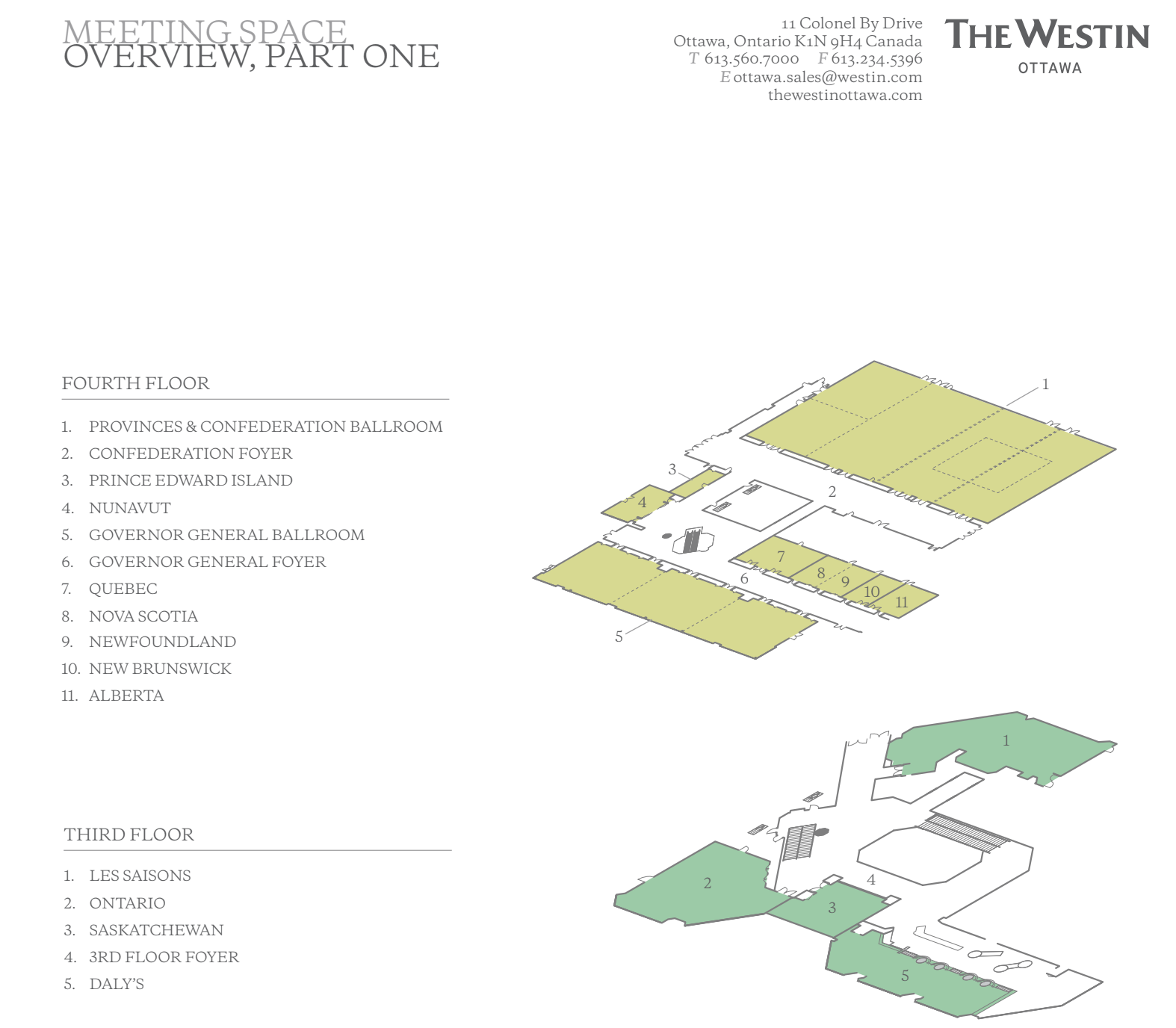

Hotel Plan

Convention Meal Service

COURSE |

MENU ITEM |

|---|---|

| Appetizer | Hot house tomato & bocconcini salad with arugula, basil olive oil, aged balsamic |

| Main Course (Based on your selection in the registration form) |

Chicken: Grass Fed Chicken Breast with smoked onions and brie

Fish: Seared Atlantic Salmon, Maple Miso Brush Vegetarian: Linguini Aglio e Olio |

| Dessert | Green tea crème brûlée, brown sugar crust |

COURSE |

MENU ITEM |

|---|---|

| Appetizer | Harvest salad with wild greens, beets, blueberries, toasted seeds, maple Dijon vinaigrette |

| Main Course (Based on your selection in the registration form) |

Chicken: Chicken Supreme

Fish: Rainbow Trout Vegetarian: Paneer Coconut Curry |

| Dessert | Fresh strawberry sabayon topped with lemon-scented whipped cream |

COURSE |

MENU ITEM |

|---|---|

| Appetizer | Cauliflower and Yukon gold potato with smoked gouda, pink peppercorn, and paprika oil |

| Main Course (Based on your selection in the registration form) |

Beef: Whole Roasted NY Steak Medallion, Au Poivre

Fish: Seared Salmon with White Wine Poached Shrimp Vegetarian: Crispy Seared Tempeh |

| Dessert | Dark chocolate praline tower with orange cranberry sauce |